The rise and state of corporate PPA’s

Baker and McKenzie (B&M) recently published a comprehensive report titled “The Rise of Corporate PPA’s” that presents the result of a survey and detailed interviews conducted with over 100 senior executives globally. Next Renewable Generation’s (NrG) CEO, Dr Dino Petrarolo, spoke on the same topic at the PowerGen Africa conference held at the Sandton Convention Centre in July 2016, although he focused specifically on the South African Commercial & Industrial space. Dr Petrarolo’s presentation was based on extensive and hands-on experience in the market. A combination of these two resources is presented in this article, which aims to shed light on the complex and exciting industry of private renewable energy Power Purchase Agreements (PPA’s).

The corporate PPA market has been growing exponentially globally – in the USA, in quarter one of 2015 alone, 1.6 giga-watts (GW) of renewable energy was contracted as PPA’s, relative to the 650 mega-watts (MW) contracted in the US from 2008 to 2012. South Africa will have placed a whopping 7GW of renewable power plants on the grid by the end of 2016, since its own Renewable Energy Independent Power Producer Programme (REIPPP) began in 2009. However, the REIPP Programme represents PPA’s contracted in the public domain; corporate PPA’s in SA are still viewed with suspicion, despite rapidly rising energy costs. [link to heat map] According to B&M’s report, this is about to change:

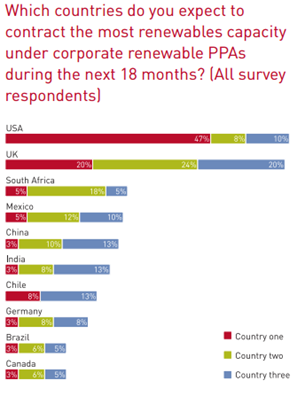

Figure 1: Countries likely to contract corporate PPA, taken from http://www.bakermckenzie.com/en/insight/publications/2015/12/the-rise-of-corporate-ppas/

South Africa is seen as the next largest potential market for renewable PPA’s, following the USA and UK.

So why are corporate PPA’s not flourishing in the SA market yet? Dr Petrarolo shed some light on potential factors in his presentation, including cost competitiveness of PPA rates relative to Eskom and municipalities’ relatively low rates, and economies of scale. The sizes of potential solar and wind plants at commercial and industrial sites are currently limited, given that power produced by renewables cannot ever exceed a site’s own consumption. SA’s current regulation does not have a proven framework and standard pricing for feeding excess power into the grid, nor is wheeling widely supported; as such, power plants built to supply corporate PPA’s cannot gain the size they require to justify high development costs of such projects.

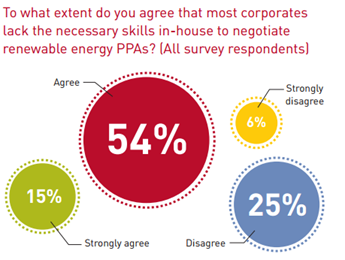

Another challenge, not exclusive to SA, is the mindset and education of the market. Locally, organisations are unsure of how to classify the PPA offering within their organisations, and as a result, it often gets misunderstood as a type of service level agreement, or is not pitched to the correct management. Although PPA’s seem to overcome the first stage of development in the US, B&M’s report listed that many PPA’s fall apart at the negotiation phase due to the innate complexity of the transaction, as seen in the image below.

Figure 2: Lack of in-house skills to negotiate a PPA, taken from http://www.bakermckenzie.com/en/insight/publications/2015/12/the-rise-of-corporate-ppas/

Although these and other challenges are still being overcome internationally, the market has grown and developed beyond a standard PPA. Synthetic or virtual PPA’s are being favoured, in which Independent Power Producers (IPP’s) and corporate off-takers of power use financial mechanisms to purchase renewable power, without the physical exchange of power between the two parties. For example, “contracts for differences” are used as a power price guarantee offered by an IPP – should the price of power rise above a set strike price, the IPP pays the difference to the off-taker. Likewise, if the market price falls below the strike price, the off-taker owes the IPP the difference. Commodity hedges and call options are also being accessed in developed markets; however, the South African market understanding and regulatory environment favours the standard PPA at this stage.

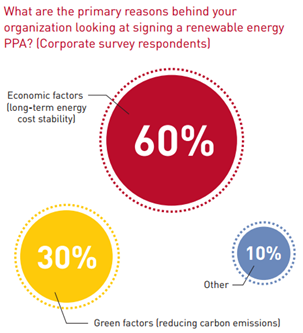

The will and need for renewable PPA’s is evident; the economic reasons for PPA’s are amplified in SA where electricity tariffs are wildly unpredictable and low economic growth makes tightening up on operating expenses a priority for local businesses. Internationally, long term cost stability remains the key driver, with sustainability goals being a close second, demonstrated clearly in the figure below.

Figure 3: Primary drivers for signing PPA’s taken from http://www.bakermckenzie.com/en/insight/publications/2015/12/the-rise-of-corporate-ppas/

In South Africa, additional drivers include Broad-Based Economic Empowerment and Enterprise Development goals, which can be built into the PPA model through creative structuring of special purpose vehicles and trust mechanisms. Dr Petrarolo adds that even when the business case for PPA adoption is clear, it requires leadership commitment to make it happen during this early stage of market adoption.

Whatever the motivation, it is clear South Africa is not immune to the corporate PPA phenomenon that is currently sweeping the globe. Contact Next Renewable Generation for a discussion on how a PPA may benefit your company.