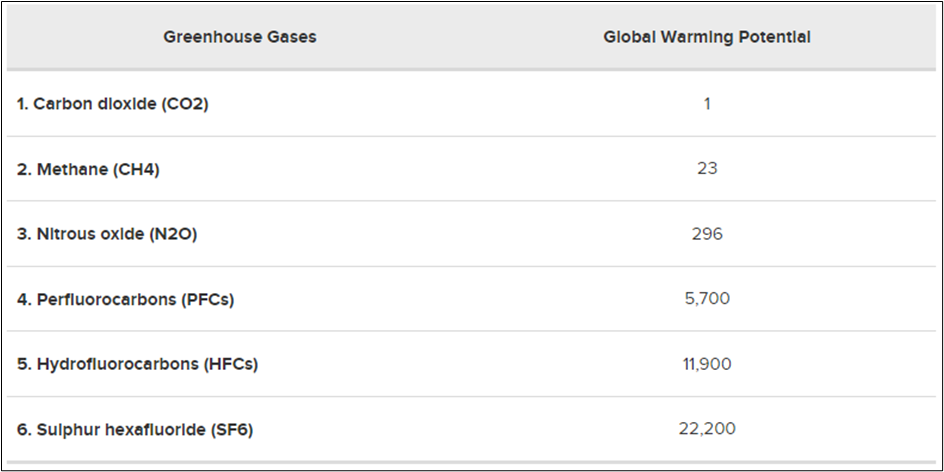

Carbon Tax rate in South Africa is calculated “according to The South African Institute of Taxation (SAIT), where the Act recognises six main greenhouse gases (GHG) emitted from industrial activities. The below table shows the gases along with their Global Warming Potential.”[1]

“To calculate total greenhouse gas emissions, the quantity of each greenhouse gas (kg/year) is multiplied by its global warming potential figure. These six numbers are then added to create a total known as the ‘carbon dioxide equivalent’ or CO2e. The amount of carbon tax is then calculated by multiplying the CO2e by the current rate of tax.”[2]

The first phase of South Africa’s carbon tax period, commenced on 1 June 2019, with a starting carbon tax rate of R120 per ton of carbon dioxide equivalent emissions. As of 1 January 2022, carbon tax increased from R134 to R144 per ton of carbon, where the South African government intends to escalate this more rapidly every year to reach at least R300 by 2026. Carbon tax will commence its second phase of rollout in 2026 when the rate will be subject to larger annual increases to reach about R450 per ton by 2030. During the second phase allowances will also fall away in the hopes of companies transitioning to cleaner and environmentally friendly technologies and processes.

How can NrG help you?

As seen by the rapid escalations projected on the carbon tax front, NrG wants to help companies in the industrial space to reduce and mitigate their GHG emissions and the effect of carbon tax on their company. Our goal is to build a financially sustainable approach to environmental sustainability and management. We provide:

- Consultations on emissions calculation,

- Industry benchmarking,

- And Investigations into mitigation projects.

[1] (BusinessTech, 2022)

[2] (BusinessTech, 2022)