Carbon Tax is a type of Pigouvian tax, which is a “tax assessed against private individuals or businesses for engaging in activities that create adverse side effects for society.”[1] Thus, it is a form of penalty imposed in response to climate change, where its implementation is being used as a way to mitigate, reduce and ultimately eliminating greenhouse gas (GHG) emissions and produce low-carbon economies. In simple terms, Carbon Tax is an environmental fee charged on the emissions produced through the burning of carbon-based fuels, such as fossil fuels.

When carbon-based fuels are burned, carbon dioxide is emitted, which is the primary compound responsible for the ‘greenhouse’ effect. The greenhouse effect is essentially, the trapping of heat within the Earth’s atmosphere resulting in global warming.

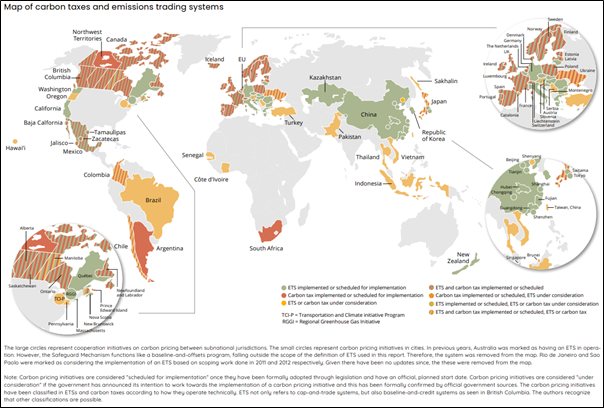

The figure below shows the map of countries that already have carbon taxes and emissions trading systems, as per The World Bank – State and Trends of Carbon Pricing 2021.

[1] Figure 1: Map showing countries with carbon taxes and emissions trading systems. (The World Bank, 2021).