Following the completion of the long awaited signature on the latest round of projects under South Africa’s Renewable Energy Independent Power Producer Procurement Programme, or REI4P, the country’s renewable energy (RE) industry can breathe a sigh of relief. The projected R56 billion investment and 2 300MW of generation capacity to be added to the grid over 5 years will help fuel progress towards the country’s clean energy transition.

One question worth asking at this point in time is when may South Africa’s RE industry be considered mature? This question is pertinent with respect to the bankability of RE projects, and has a significant influence on unlocking investment for the entire industry. Investors are generally more comfortable with mature technologies and industries, as these have less risk associated with them. The net result is that capital is more readily available at a lower cost.

However, this is no simple question to answer. Indeed, it can be tackled in a number of ways. This article will examine several different aspects relating to industry maturity and how it may be defined. It will also highlight some of the different factors to be considered when assessing the state of South Africa’s RE industry.

Given that any energy-associated industry is built from different energy technologies, it may be useful to examine the question first from a technological point of view. With any energy technology, traits such as cost and reliability of energy supply play a significant role in the decision to switch from one energy technology to another. This decision can be simplified somewhat to two tipping points that occur in transitions between energy technologies. The first is when the new build of a new energy technology becomes cheaper than the new build of an established energy technology. When such a point is reached, the business case for the new and now cheaper technology will often see it adopted as the preferred technology for the future.

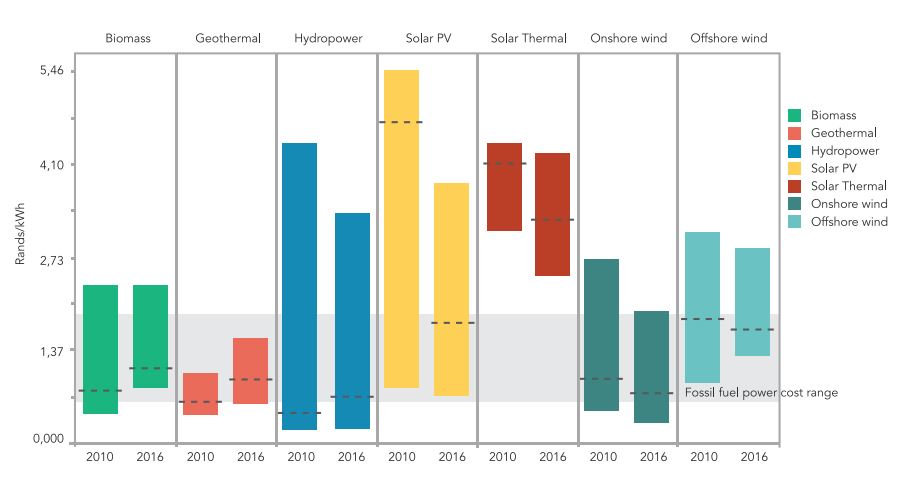

If we examine the energy landscape in South Africa, it is clear that this first tipping point has already been reached. Using the utility-scale market of the REI4P as a reference due to the large amount of information available, Figure 1 below compares the cost of different energy technologies. As can be seen, the new build of renewable energy technologies (RETs), such as solar PV and wind, is already cheaper than that of more established energy technologies, such as coal and gas.

Figure 1: Lifetime cost comparison of energy technologies in South Africa [1] courtesy of GreenCape Energy Services

Figure 1: Lifetime cost comparison of energy technologies in South Africa [1] courtesy of GreenCape Energy Services

The second tipping point is when the new build and use of an energy technology becomes cheaper than the continued use of an existing and established energy technology. The point at which this happens is more difficult to determine. Energy utilities are not always transparent regarding the cost of energy supplied from existing energy technologies or the overall system cost of energy sourced from the national grid. Furthermore, the cost of energy supplied from so called “dirty” energy technologies typically does not take into account indirect costs such as harm to the environment, which are difficult to quantify.

In the case of South Africa, the state utility Eskom owns and runs many old coal-fired power stations, many of which are free from debt financing and thus able to provide energy at low prices. While it can be said that South Africa is yet to reach this second tipping point, many of the country’s coal power stations are scheduled for decommission soon [2]. In addition, as of April 2018 [3] several of the country’s coal stations are facing significant coal supply issues. These factors highlight that the second tipping point may arrive sooner than expected.

Yet assessing different energy technologies only on the basis of cost is simplistic. It does not take into account each technology’s value proposition. When assessing the state of maturity of South Africa’s RE industry, it is important to consider the value propositions on offer by different energy technologies. This includes the value they offer to the country’s future energy mix, and which energy technologies they may be in a position to replace. Furthermore, the number of local jobs created is also of importance, given the country’s high unemployment rate. This is a common case of ensuring that one compares apples with apples.

Unfortunately, this argument is often twisted by individuals to suit their own arguments and agendas. Indeed, given the complexity of the energy sector globally and multitude of differing data and statistics available, it can be difficult to be sure that one is analyzing different technologies on a level basis. This leaves the door open for misleading interpretations of the facts and use of arguments aimed at promoting one technology over another.

Finally, an industry does not consist solely of technology. Of equal importance are the value and supply chains, comprising trained professionals and production processes amongst others. While these are entire topics in their own right, the maturity of such chains also proves difficult to assess. This is due to the fact that the links and components within these chains typically form part of supply and value chains of other industries and sectors.

A case in point is that of concentrating solar power (CSP) technologies. A 2013 report by the Southern African Solar Thermal Energy Association of Southern Africa (SASTELA) highlighted how complementary industries such as automotive and defence could be leveraged to support and strengthen the CSP supply and value chains of the technology within South Africa. These industries could also be used to leverage the country’s position in the global CSP innovation network [4]. Utilising a nation’s expertise in certain industries to strengthen its competencies in new and emerging industries is beneficial for economic growth and job creation. These are two areas which are currently in the spotlight in South Africa, as both have the potential to contribute greatly towards the country’s RE industry reaching a state of maturity.

In conclusion, it can be said that while South Africa’s RE industry is well on its way to reaching a state of maturity, it has yet to definitely reach such a point. While recent events such as the signing of the REI4P projects are encouraging, greater commitment and policy certainty is needed from government and other stakeholders within the industry and wider energy sector before such a state is achieved. The challenge of achieving a higher percentage of renewables in the national grid without threatening grid stability needs to be addressed. Furthermore, the industry would benefit from knowledge of a clear and transparent pipeline of projects to be developed in the future. Lastly, the implementation of more efficient decision-making and project development processes will also contribute towards the country’s clean energy transition.

References:

[1] CSIR Energy Centre, “Least Cost Electricity Mix for South Africa – Optimisation of the South African power sector until 2050,” CRSES, 2017. [Online]. Available: http://www.crses.sun.ac.za/files/news/CSIR_BischofNiemz_pp.pdf. [Accessed: 02-Feb-2018].

[2] S. Njobeni, “Eskom planned to decommission ages ago,” Business Report, 2017. [Online]. Available: https://www.iol.co.za/business-report/energy/eskom-planned-to-decommission-ages-ago-8360289. [Accessed: 28-Apr-2018].

[3] C. Yelland, “Eskom faces new coal supply crisis: report,” Business Tech, 2018. [Online]. Available: https://businesstech.co.za/news/energy/238081/eskom-faces-new-coal-supply-crisis-report/. [Accessed: 30-Apr-2018].

[4] SASTELA, Dti, and GIZ, “Assessment of the localisation, industrialisation and job creation potential of CSP infrastructure projects in South Africa – A 2030 vision for CSP,” 2013.

By Greg Prentice